Download our infographic to learn why checks and balances are essential to ensure your organization always maintains regulatory compliance standards.

Is your business at risk of violating compliance regulations?

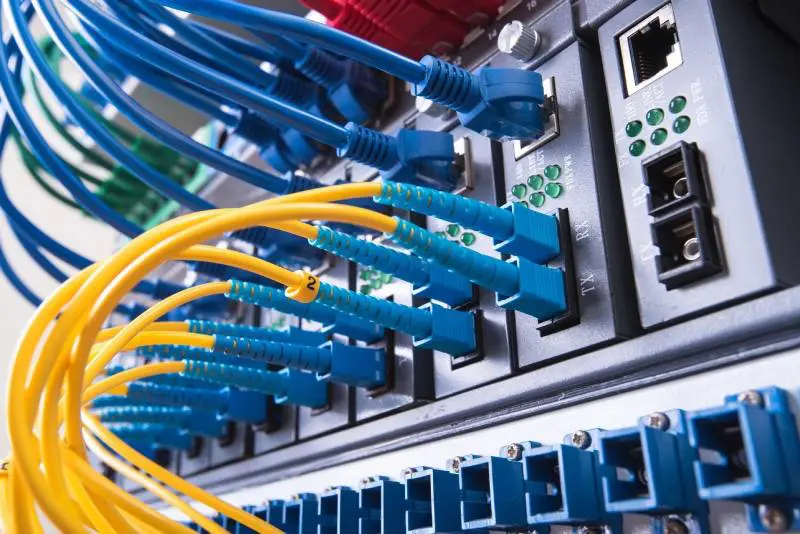

It is critical for businesses of all sizes to avoid compliance violations that can result in financial losses and other penalties. Common violations include failure to conduct routine compliance audits, monitoring access and keeping documents in order. Unfortunately, tracking and meeting compliance standards on your own can be difficult. If you are not cautious, you may incur fines or leave yourself vulnerable to cyberthreats.

Compliance auditing is the process of determining whether an organization is following regulatory guidelines. It can help and it is especially useful for small businesses struggling to meet all their industry’s legal requirements.

If you have concerns that your business may not be in perfect compliance with all government-mandated rules, our infographic can help you out.